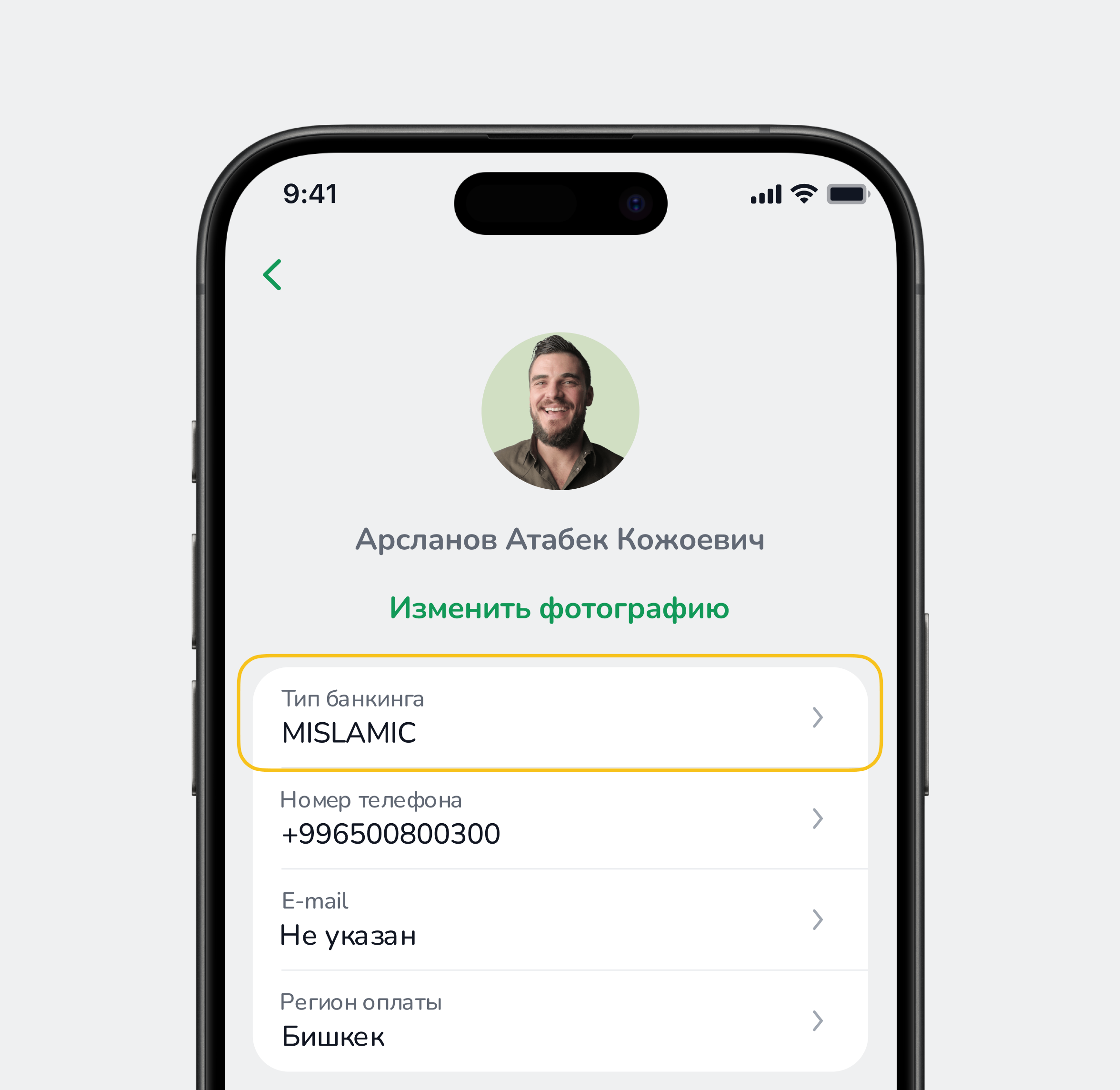

Islamic Banking MBANK

Mobile banking based on Shariah principles and standards

MISLAMIC is

Compliance with Shariah principles

All products comply with Shariah standards, without interest and speculation

Transparent conditions in your finances

Only fair agreements, clear conditions and confidence in every transaction

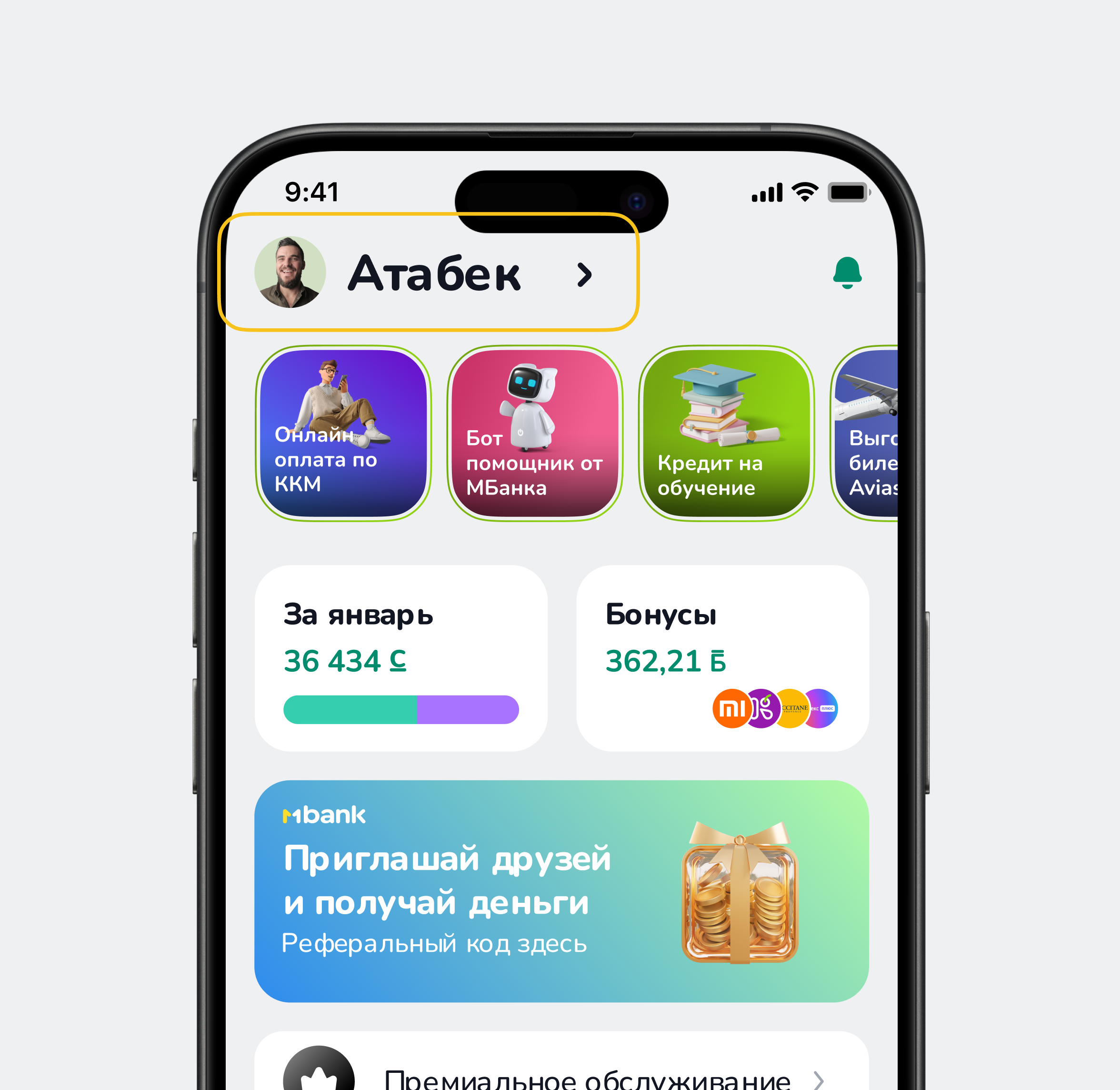

More than 1000 services in a couple of clicks

Pay for utilities, communications, internet and much more without unnecessary steps

What does MISLAMIC offer?

Adal Installment

Adal Installment is the purchase of goods and services in installments without interest or overpayments, based on the Islamic financing principle of Qard Hasan.

MIslamic bank cards

MIslamic Shariah Compliant Debit Card

Murabaha

A Murabaha agreement is a transaction that provides for the sale by installments of goods purchased by the bank at the request of the client, or owned by the bank at the time of the client's request. The sale price of the goods by the bank is determined by the parties as the sum of the purchase price and the margin agreed by the parties to the contract

Mudaraba Deposits

Mudaraba is a partnership profit between the Bank and the client for a pre-agreed period

Istisnaa

Istisnaa is a treaty under which one party (the contractor) undertakes to perform a specific job or manufacture a product/goods at the request of the other party (the customer) and deliver the result to the customer within a specified time frame, and the customer undertakes to accept the result of the work and pay the pre-agreed price.

MISLAMIC is more than just finance

Prayer time

Find out the current prayer schedule

Qibla compass

Easily find direction for prayer

Calculation of Zakat

Preliminary calculation of mandatory donations

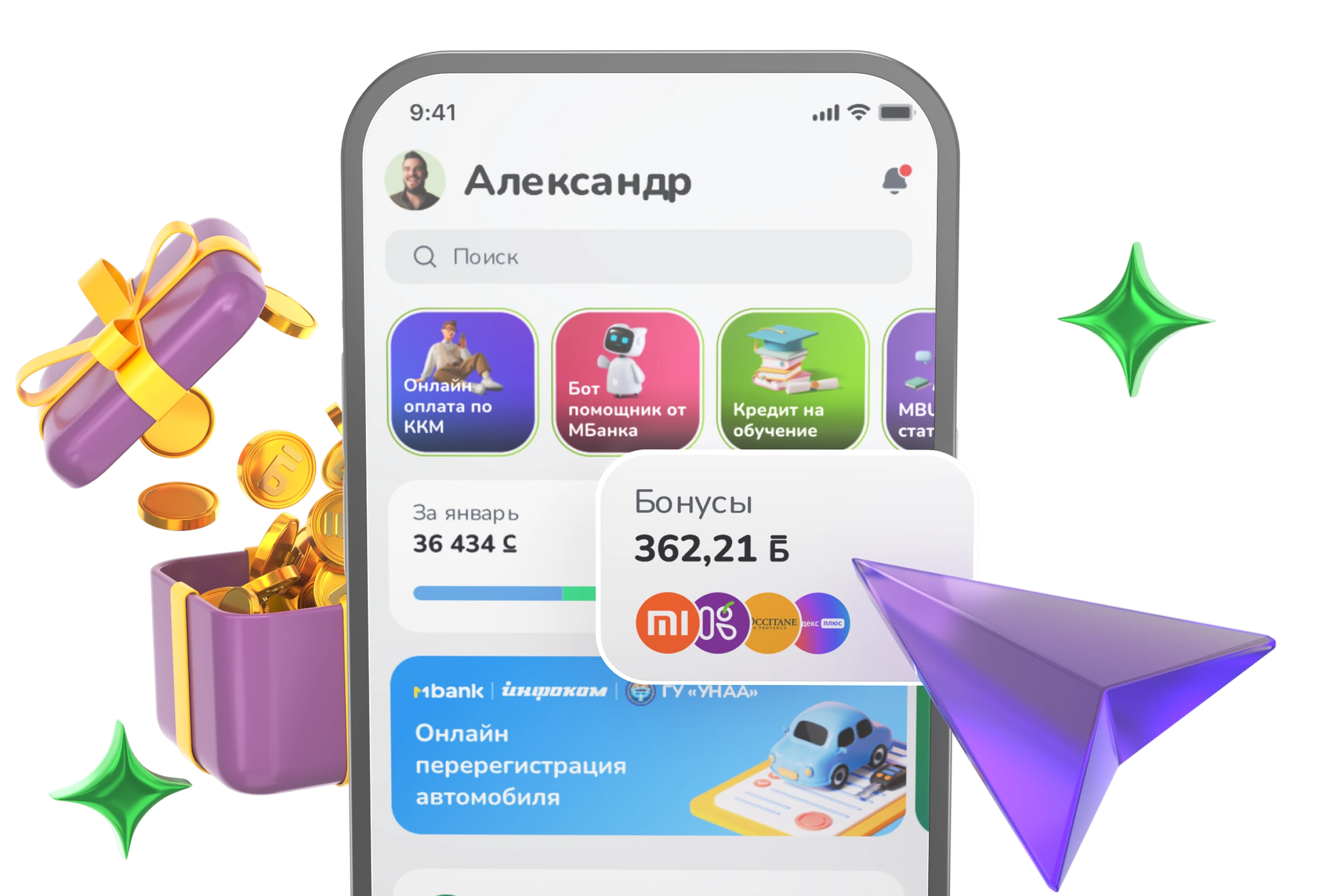

MBONUS Loyalty Program

Accumulate bonuses for purchases and pay for services with them. Benefit in every purchase