en

For individuals

For business

MAcademy

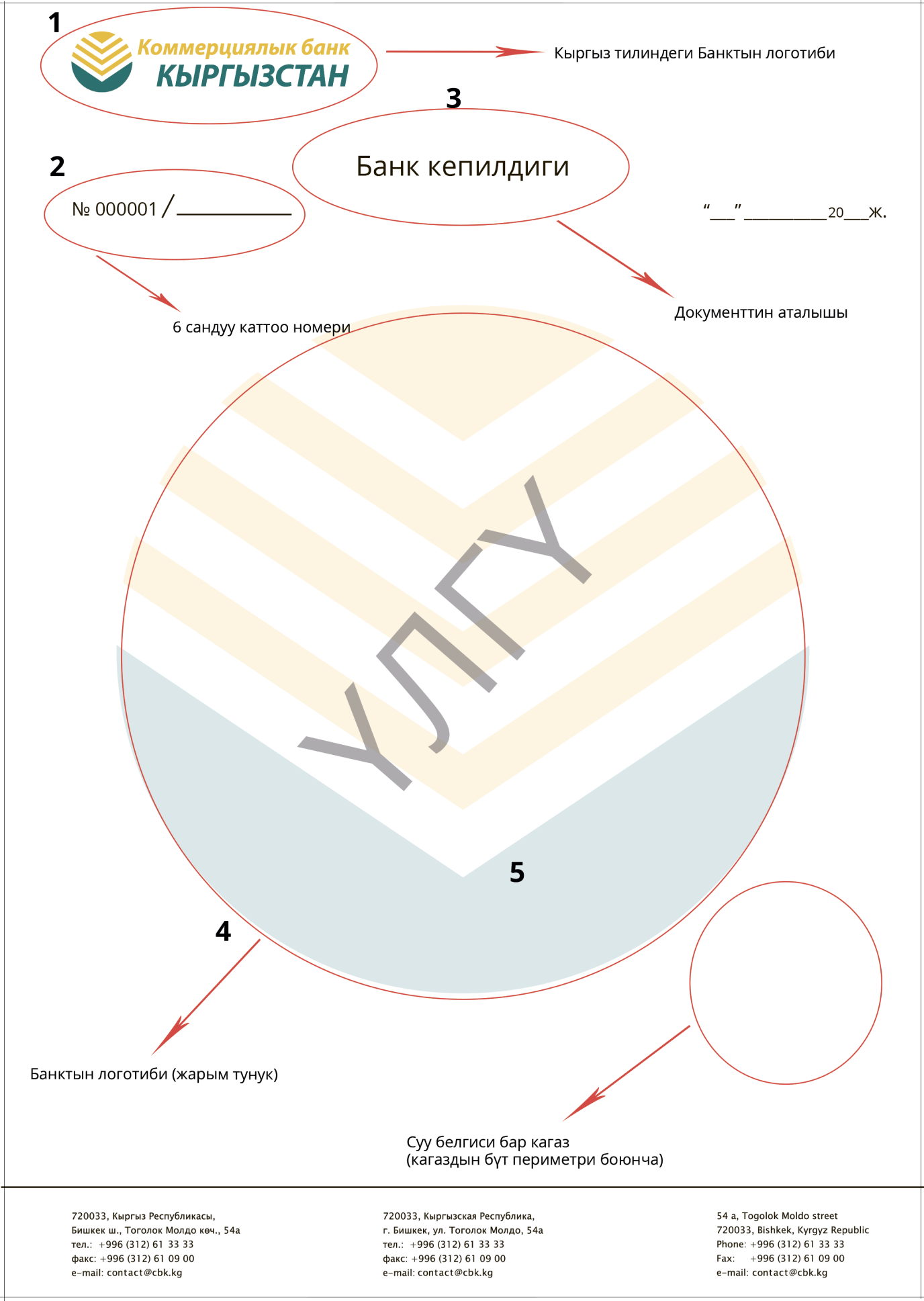

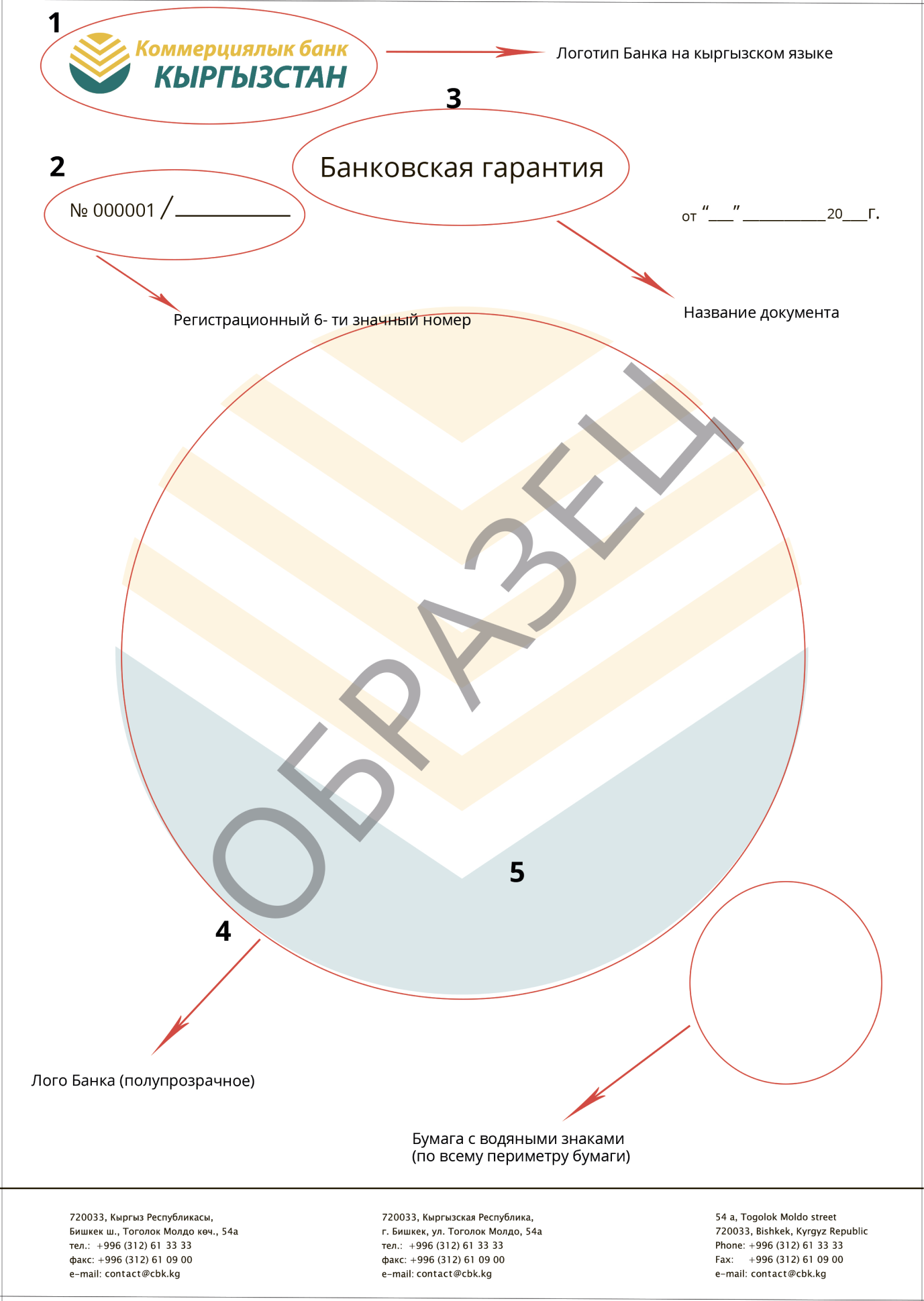

Bank guarantee - an irrevocable, written obligation of the Bank to make a payment of a certain amount to the recipient under the guarantee upon presenting them with a demand for payment in accordance with the terms of the guarantee.

Characteristics of our bank guarantees

Be sure to pay attention to the following characteristics:

Main types of bank guarantees:

- Bid bond;

- Advance payment guarantee;

- Performance guarantee;

- Payment guarantee;

- Counter guarantee;

Documents, required for getting bank guarantee:

- Application for a bank guarantee;

- Information on the bank guarantee project (tender information, contract, etc.);

- Constituent documents of a company;

- Financial statements for the last and previous reporting years with a breakdown of accounts receivables and payables in the balance sheet, including interim financial statements (monthly/quarterly/semi-annually) if available;

- Certificate from the State Tax Office and Social Fund on the absence of debt;

- Decision of the authorized person to conclude a bank guarantee agreement and provide a collateral;

- Pledge documents (copies of passports of pledge givers and their spouses, title documents, certificate of absence of restrictions (encumbrances) on real estate collateral);

* Dear clients, if you encounter illegal actions or unreasonable requests from the Bank's employees when reviewing applications or issuing loans, we ask you to report such cases to the Bank's Contact Center at 0 312 61-33-33 or WhatsApp +996 556 61-33 -33.

All such cases will be considered personally by the Bank's management.